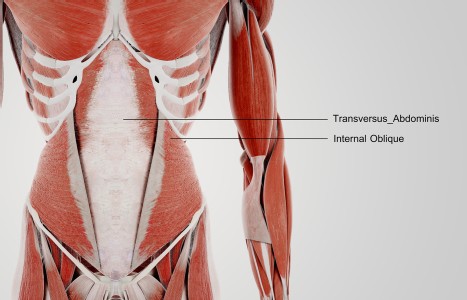

TrA-2, my primary needle location, I needle 95% of the time and I think it works the best. You’ll know you have the right point location when you discover the muscle twitching when applying electric stimulation.

Cleaning House With Your Insurance

It's time to clean house and dump some insurance. Time to save a few bucks and make your overall insurance program leaner and meaner. So let's get to work.

A good place to start is with your automobile insurance. Lots of dead weight there that we can get rid of and save a bundle. What is the deductible on the collision portion of your policy? If it is below $500, it is time to raise that to at least $1,000. Let's face it; you would not turn in a claim for a small fender-bender because you know that the company would probably raise your premiums or drop your policy. If that's the case, why have a low deductible? The higher deductible will save you some money. Do you have towing on your policy? Do you belong to an auto club? You don't need towing if you belong to an auto club since towing is included with your membership. Time to dump that and save those dollars.

As a professional, you probably have higher limits on your liability coverage. You would be better off with an "umbrella" liability policy that gives you much higher limits for less money. You can trim back your liability limits on your auto policy to meet the threshold of the umbrella policy. All in all, you will have a substantial increase in your liability protection and you will save money on your total premiums. A win-win situation.

Got a homeowners policy? Time to increase the deductibles on that policy too. While we are at it, why not increase the deductibles on all your policies. Take a look at your health insurance and see what a larger deductible will do to the premium. Big savings here. You even have a deductible on your disability policy. It is referred to as the elimination period before benefits kick in. If you have been in practice for a while, I would suggest reviewing your coverage and see if you can afford to increase the elimination period. That can save you some premium dollars.

Now comes time to pull out those life insurance policies. When you applied for your policies, did you get the best possible rating or did they charge you an "extra" premium for health reasons? If they did, maybe you can get that extra charge removed and save some dollars. You need to contact the company and see what the process is to do that. Did you have a term rider added to your policy when you purchased it? Has it outlived its usefulness? It might be a good idea to check that out. Last but far from least, if you have an old term policy, it might be a good idea to get rid of it or replace it with a policy that will give you permanent coverage.

If you have a life insurance policy with a huge loan you might check to see if you have any dividends that can be applied against the loan. That can save you from paying off the loan and also save you on annual interest payments. If that loan is very large and you are still in good health, I would also suggest that you see if a new policy would be a better deal instead of continuing to pay a full premium plus interest for a death benefit that has been reduced by the amount of the loan.

You have lots of policies with lots of dollars in premiums being paid to various companies. The companies are not going to contact you and offer ideas on how to save money on your policies. It is totally up to you. It's time for you to clean house!