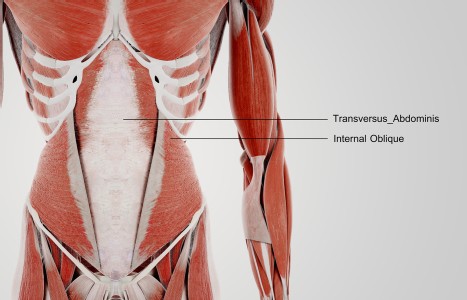

TrA-2, my primary needle location, I needle 95% of the time and I think it works the best. You’ll know you have the right point location when you discover the muscle twitching when applying electric stimulation.

How To Survive When Times are Tough

Ah yes, times are tough.

I am sure this does not come as a big surprise to you. Drive down any street and see how many homes have "for sale" signs are stuck in the lawn. This is just one sign of what's going on nationwide. I don't think we will see the bottom for another few years. With that gloomy forecast looming ahead it is time to make sure that you have your finances in order so that you can ride out this storm.

It is time to take a good long look at everything and make sure everything is working as best as it can. I would start by reviewing all outstanding loans. Do you have the best interest rate that you can get? Not sure? You need to be sure.

Get all your information together and start making some calls and see what you can do. You may be pleasantly surprised. It may be a good idea to consolidate some of them to improve your cash flow. Everything is about cash flow. I never hear anyone complaining when they have good positive cash flow with money left over after everyone has been paid. It is when a person does not have enough to pay all of their bills and ends up with a negative cash flow. Like I said, it all boils down to cash flow. Now is the time to improve yours.

Do you have a mortgage? Is it at a fixed rate? If not, you should consider changing to a fixed rate mortgage so you will know what your payments are going to be for years to come. If you don't own a home, keep your eyes open because some real bargains will be on the market in the next year. Values are dropping and the market is flooded, so just be patient.

What about your insurance? Do you have what you need? When was the last time you did a comprehensive review of everything? It's time so get all those policies out and see what is going on.

Call your agents and tell them you need a one page summary of what you have including policy number, company name, what it covers, amount of deductibles, premium amount and mode of premium. It might be a good idea to also find out what it is for your business, so you can make sure you are taking a tax deduction for premiums that qualify as a business expense. While you are on the phone ask your agent if they have any suggestions to improve coverage and lower the cost. Make sure you check out increasing the deductibles. That can save you a bundle.

Do you have any money in the bank in savings? If you do, it is just rotting there since they pay you nothing in interest. The same is true with any excess amounts in your checking accounts. While you are checking things at your bank, see what else they are charging you for and see if you can get a better deal elsewhere. I am sure that you can. If you look closely you will see that you paid more in fees than you earned in interest. You need to maximize all of your money and minimize all of your fees that you pay.

How are your investments doing? The market is going to continue to move up and down and be very shaky. It might be a good idea to make sure you are in good solid investments with a great track record. If not, move your money before you lose it all. Like I said, these are tough times so be prepared.

Got a retirement plan? Are you happy with it? If not, maybe it is time to see what else is out there. Are you paying more in fees than what you are earning in interest? Like I said, it is time to review everything and improve cash flow.

Keep your personal and business overhead as low as you can so you can keep your hands on more of your cash. There will be some opportunities to pick up some great buys if you have the cash to do it with and can hold onto it without putting a strain on your financial picture. It is time to cull so you can be lean and mean!

I am not trying to scare you with all of this. I am just trying to make sure you are prepared for what is coming. If you do this you will be fine and come out of this much better than most.

Good luck!